Financial Market Bubbles and Crashes: Uncovering the Anatomy of Market Volatility

The financial markets are a complex and dynamic system that has captivated the interest of investors, economists, and policymakers alike. Throughout history, these markets have experienced periods of irrational exuberance followed by devastating crashes, resulting in significant financial losses and economic turmoil. Understanding the genesis and characteristics of financial market bubbles and crashes is essential for navigating these treacherous waters and protecting your investments.

Defining Financial Market Bubbles

A financial market bubble is a period of rapid and unsustainable growth in the price of an asset, driven by speculation and excessive optimism. Unlike a bull market, which is characterized by solid economic fundamentals and steady price increases, a bubble is fueled by irrational exuberance and often results in a sharp correction or crash.

4 out of 5

| Language | : | English |

| File size | : | 10581 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 384 pages |

| Screen Reader | : | Supported |

Anatomy of a Market Bubble

Financial market bubbles typically follow a predictable pattern:

- Expansion: The bubble begins with a period of strong economic growth and rising asset prices. Investors are lured by the prospect of quick profits and pour money into the market.

- Exuberance: As prices continue to climb, a sense of euphoria pervades the market. Investors become overconfident and take on excessive risk, often investing with borrowed funds.

- Peak: The bubble reaches its peak when prices become detached from underlying fundamentals. Speculation and momentum trading drive prices to unsustainable levels.

- Correction: Eventually, a trigger event—such as a negative economic report or a regulatory change—causes investors to reassess the market's fundamentals. Prices begin to fall, triggering a wave of selling that can cascade into a full-blown crash.

Historical Examples of Market Bubbles

History is replete with examples of financial market bubbles:

- Tulip Mania (17th century): A speculative frenzy over tulip bulbs in the Netherlands led to astronomical prices and a subsequent crash that bankrupted many investors.

- South Sea Bubble (18th century): A British company with a dubious business plan promised investors vast riches in South America. The bubble burst, and thousands of investors lost their fortunes.

- Wall Street Crash of 1929: A combination of excessive speculation, high leverage, and weak economic fundamentals led to the collapse of the U.S. stock market, ushering in the Great Depression.

- Dot-com Bubble (1990s): The rapid growth of the internet fueled a surge in investment in technology companies. When the bubble burst in 2000, it wiped out trillions of dollars in wealth.

- Housing Bubble (2000s): Low interest rates and lax lending standards led to a surge in mortgage lending and home prices. The bubble burst in 2008, triggering the global financial crisis.

Factors Contributing to Market Bubbles

Several factors can contribute to the formation of financial market bubbles:

- Excessive optimism: Investors become overly optimistic about future market performance, leading them to take on excessive risk.

- Easy access to credit: Low interest rates and lax lending standards make it easier for investors to borrow money and invest in risky assets.

- Lack of regulation: Weak regulatory oversight can allow for abuses and excessive speculation.

- Behavioral biases: Investors often exhibit cognitive biases, such as herd mentality and confirmation bias, which can lead to irrational decision-making.

Consequences of Market Crashes

Financial market crashes can have severe consequences for investors and the overall economy:

- Lost wealth: Investors may lose significant amounts of money, particularly if they have invested with borrowed funds.

- Economic recession: Market crashes can lead to a decline in economic activity, as businesses and consumers reduce spending.

- Instability: The uncertainty and volatility associated with market crashes can damage investor confidence and hinder economic growth.

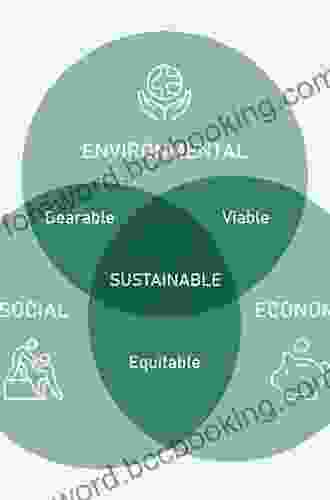

Preventing Market Bubbles and Crashes

Preventing financial market bubbles and crashes is a complex challenge, but several measures can be taken:

- Strong regulation: Regulators can implement strict lending standards, prohibit risky practices, and increase transparency in financial markets.

- Financial literacy: Educating investors about market risks, behavioral biases, and the importance of diversification can help prevent excessive speculation.

- Central bank oversight: Central banks can use monetary policy tools to moderate economic growth and prevent asset price bubbles.

- Market surveillance: Regulators can monitor market activity for signs of excessive speculation and take corrective action when necessary.

Financial market bubbles and crashes are a recurring phenomenon that has the potential to inflict significant financial and economic damage. Understanding the anatomy of these events, their historical precedents, and the factors that contribute to them is crucial for mitigating their risks. By implementing sound regulatory policies, promoting financial literacy, and fostering market surveillance, we can help prevent and mitigate the negative consequences of financial market bubbles and crashes.

"Financial Market Bubbles and Crashes: Uncovering the Anatomy of Market Volatility" is an essential resource for investors, policymakers, and anyone interested in understanding the complex dynamics of financial markets. This comprehensive guide provides an in-depth analysis of the causes, consequences, and prevention of market bubbles and crashes, empowering readers with the knowledge to navigate these tumultuous waters successfully.

Free Download your copy today and gain a deeper understanding of the financial markets and the forces that shape their behavior.

4 out of 5

| Language | : | English |

| File size | : | 10581 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 384 pages |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Helen Bannerman

Helen Bannerman Harlan Hubbard

Harlan Hubbard Todd Duff

Todd Duff Heather Alexander

Heather Alexander Sheila A Sorrentino

Sheila A Sorrentino Helen Garabedian

Helen Garabedian Harvey Tyson

Harvey Tyson John Mcpherson

John Mcpherson Jillian Godsil

Jillian Godsil Mary Ruth Shields

Mary Ruth Shields Heidi Marx

Heidi Marx P Brian Noble

P Brian Noble Hayward Cirker

Hayward Cirker Ryan Minkoff

Ryan Minkoff Helen Fields

Helen Fields Howard Reich

Howard Reich Henry Dillon

Henry Dillon Leslie Helm

Leslie Helm John Woodward

John Woodward Jason Selk

Jason Selk

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Chance FosterPlay Basketball Like Stephen Curry: The Ultimate Guide to Mastering the Art...

Chance FosterPlay Basketball Like Stephen Curry: The Ultimate Guide to Mastering the Art... Justin BellFollow ·18k

Justin BellFollow ·18k Robert FrostFollow ·8.8k

Robert FrostFollow ·8.8k John KeatsFollow ·19.2k

John KeatsFollow ·19.2k Fernando BellFollow ·5.5k

Fernando BellFollow ·5.5k Bradley DixonFollow ·12k

Bradley DixonFollow ·12k Melvin BlairFollow ·16.2k

Melvin BlairFollow ·16.2k Ismael HayesFollow ·17k

Ismael HayesFollow ·17k Carlos DrummondFollow ·4.3k

Carlos DrummondFollow ·4.3k

Fabian Mitchell

Fabian MitchellUnleash the Adventure: Family Fun in the Black Hills

Nestled amidst the rolling hills...

Alfred Ross

Alfred RossUnleashing Peak Business Performance: A Journey of...

In today's rapidly evolving business...

Fernando Bell

Fernando BellEmbrace the Prophetic Voice of Howard Zinn: A Journey...

As we navigate the complexities of our...

Jonathan Franzen

Jonathan FranzenChildren of the Arctic: A Literary Expedition to the...

In the annals of...

Branson Carter

Branson CarterYou Can Be Neutral on a Moving Train: A Transformative...

Welcome, dear reader,...

4 out of 5

| Language | : | English |

| File size | : | 10581 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 384 pages |

| Screen Reader | : | Supported |