Lower Your Taxes Big Time in 2024

Are you ready to take control of your tax bill and keep more of your hard-earned money? In this comprehensive guide, we'll uncover the secrets to legally reducing your tax burden in 2024.

4.3 out of 5

| Language | : | English |

| File size | : | 5206 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 368 pages |

Maximize Deductions

Deductions reduce your taxable income, meaning you pay less in taxes. Here are some key deductions to consider:

- Standard Deduction: A flat amount you can deduct without itemizing. In 2024, the standard deduction is $13,850 for single filers and $27,700 for married couples filing jointly.

- Itemized Deductions: Allow you to deduct specific expenses. Common itemized deductions include mortgage interest, property taxes, charitable donations, and medical expenses.

- Business Expenses: If you're self-employed, you can deduct expenses related to your business, such as office supplies, travel, and equipment.

Claim Credits

Tax credits directly reduce your tax liability, dollar for dollar. Here are some credits worth exploring:

- Earned Income Tax Credit (EITC): A refundable credit for low- to moderate-income working individuals and families.

- Child Tax Credit (CTC): A per-child credit for parents and guardians.

- Child and Dependent Care Credit: A credit for expenses related to childcare or dependent care.

Take Advantage of Tax-Advantaged Accounts

Certain accounts allow you to defer or reduce taxes on your investments. Consider these options:

- 401(k) and IRA Contributions: Contributions to these retirement accounts reduce your taxable income and grow tax-deferred.

- Health Savings Accounts (HSAs): Contributions to HSAs are tax-free and can be used to pay for qualified medical expenses.

- 529 Plans: Contributions to these college savings plans are state income tax-free in many states.

Plan Ahead

Proper tax planning is crucial for minimizing your tax liability. Start by:

- Estimating Your Taxes: Use tax software or a CPA to estimate your tax bill and identify areas for improvement.

- Making Estimated Tax Payments: If you expect to owe more than $1,000 in taxes, make estimated tax payments throughout the year to avoid penalties.

- Reviewing Your Withholdings: Adjust your payroll withholdings to ensure you're not overpaying or underpaying taxes.

Seek Professional Help

If you're not comfortable navigating the complexities of the tax code, don't hesitate to consult with a qualified tax advisor. They can provide personalized guidance and ensure you're taking all the necessary steps to minimize your taxes.

By implementing the strategies outlined in this guide, you can significantly reduce your tax burden in 2024. Remember, knowledge is power when it comes to taxes. Take control of your finances and keep more of your hard-earned money by following these proven techniques.

Don't miss out on the opportunity to save big on your taxes! Free Download your copy of Lower Your Taxes Big Time 2024 today and unlock the secrets to tax savings.

4.3 out of 5

| Language | : | English |

| File size | : | 5206 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 368 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Katharine Branning

Katharine Branning Mariama Williams

Mariama Williams Jeffrey Wilson

Jeffrey Wilson Helen Perelman

Helen Perelman Hicham And Mohamed Ibnalkadi

Hicham And Mohamed Ibnalkadi Harry Whitewolf

Harry Whitewolf Heather Forest

Heather Forest Heather N Keaney

Heather N Keaney Seth Ring

Seth Ring Karim Shamsi Basha

Karim Shamsi Basha Jen L Grey

Jen L Grey Peyo

Peyo Shandra Nalia

Shandra Nalia Shawna James

Shawna James Segun Adebajo

Segun Adebajo Jonathan E Hillman

Jonathan E Hillman Hendrie Weisinger

Hendrie Weisinger Julie Plagens

Julie Plagens Lisa M Rose

Lisa M Rose Hongyu Guo

Hongyu Guo

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

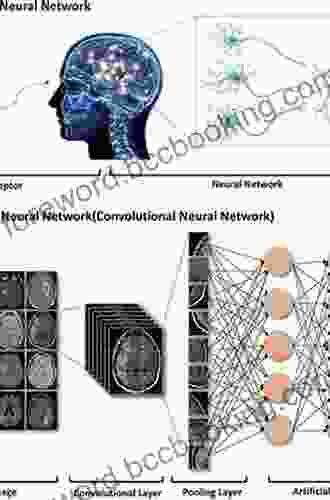

Ronald SimmonsUnveiling the World of Deep Learning and Convolutional Neural Networks for...

Ronald SimmonsUnveiling the World of Deep Learning and Convolutional Neural Networks for...

Kazuo IshiguroWhere Snowflakes Dance And Swear: A Whimsical Adventure into the Realm of...

Kazuo IshiguroWhere Snowflakes Dance And Swear: A Whimsical Adventure into the Realm of...

Dennis HayesUnveiling the Essential Guide: Mitigating Contract Risks for Business Success

Dennis HayesUnveiling the Essential Guide: Mitigating Contract Risks for Business Success Giovanni MitchellFollow ·10.4k

Giovanni MitchellFollow ·10.4k Diego BlairFollow ·5.2k

Diego BlairFollow ·5.2k Albert ReedFollow ·4.8k

Albert ReedFollow ·4.8k Graham BlairFollow ·15.5k

Graham BlairFollow ·15.5k Chuck MitchellFollow ·16.9k

Chuck MitchellFollow ·16.9k Eugene ScottFollow ·12.5k

Eugene ScottFollow ·12.5k Mario SimmonsFollow ·5.1k

Mario SimmonsFollow ·5.1k Holden BellFollow ·3k

Holden BellFollow ·3k

Fabian Mitchell

Fabian MitchellUnleash the Adventure: Family Fun in the Black Hills

Nestled amidst the rolling hills...

Alfred Ross

Alfred RossUnleashing Peak Business Performance: A Journey of...

In today's rapidly evolving business...

Fernando Bell

Fernando BellEmbrace the Prophetic Voice of Howard Zinn: A Journey...

As we navigate the complexities of our...

Jonathan Franzen

Jonathan FranzenChildren of the Arctic: A Literary Expedition to the...

In the annals of...

Branson Carter

Branson CarterYou Can Be Neutral on a Moving Train: A Transformative...

Welcome, dear reader,...

4.3 out of 5

| Language | : | English |

| File size | : | 5206 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 368 pages |