Mastering Mergers and Acquisitions: A Comprehensive Guide for Business Success

Mergers and acquisitions (M&A) represent powerful tools for businesses seeking to expand their market share, diversify their operations, and achieve strategic growth. However, navigating the intricacies of these complex transactions can be a daunting task. To guide business leaders through this challenging landscape, we present a comprehensive guide that demystifies the M&A process, providing essential insights and practical strategies for a successful journey.

Understanding the Fundamentals of Mergers and Acquisitions

Mergers combine two separate entities into a single, larger organization, while acquisitions involve the Free Download of one company by another. Both transactions can serve as catalysts for growth and diversification. Understanding their distinct characteristics is crucial for making informed decisions.

4.5 out of 5

| Language | : | English |

| File size | : | 843 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 422 pages |

| Lending | : | Enabled |

Types of Mergers and Acquisitions

There are several types of M&A transactions, including:

- Horizontal Merger: Two companies operating in the same industry and at the same level of the supply chain merge to increase market share and reduce competition. - Vertical Merger: Companies at different stages of the production or distribution process merge to gain control over the entire supply chain. - Lateral Merger: Companies in related industries merge to expand their product or service offerings. - Conglomerate Merger: Companies in unrelated industries merge to diversify their operations and reduce risk. - Acquisition: One company Free Downloads a controlling interest in another company, often to gain access to its assets, market share, or technology.

Benefits of Mergers and Acquisitions

M&A transactions offer numerous potential benefits, such as:

- Increased Market Share: Combining with a competitor can increase market share and strengthen the merged entity's competitive position. - Diversification: Acquiring companies in different industries or markets can reduce overall risk and provide a more stable revenue stream. - Access to New Technologies or Products: Acquisitions can provide access to new technologies, products, or services, fostering innovation and growth. - Cost Savings: Merging or acquiring can lead to operational efficiencies and economies of scale, reducing overall costs. - Expansion into New Markets: M&A transactions can facilitate entry into new geographic markets or customer segments.

Steps Involved in the M&A Process

The M&A process typically involves several key steps:

1. Target Identification and Due Diligence

Identify potential acquisition targets that align with the company's strategic goals. Conduct thorough due diligence to assess the target's financial stability, market position, and potential liabilities.

2. Negotiation and Deal Structuring

Negotiate the terms of the transaction, including price, payment structure, and post-merger integration plans. Determine the optimal deal structure (e.g., merger, acquisition, joint venture) to meet the objectives of both parties.

3. Regulatory Approvals

Obtain necessary regulatory approvals, such as antitrust reviews and shareholder votes. Ensure compliance with all applicable laws and regulations.

4. Integration and Post-Merger Management

Plan and execute the post-merger integration process to ensure a smooth transition and maximize synergies between the merged entities. Communicate effectively with stakeholders and address any challenges that arise.

Strategies for Successful Mergers and Acquisitions

To increase the likelihood of a successful M&A transaction, consider the following strategies:

- Clear Strategic Alignment: Ensure that the M&A aligns with the company's long-term strategic vision and objectives. - Thorough Due Diligence: Conduct a comprehensive assessment of the target company to identify potential risks and opportunities. - Effective Deal Structuring: Negotiate a deal structure that fairly compensates both parties and aligns incentives. - Swift Regulatory Approvals: Proactively address regulatory requirements to minimize delays and ensure a smooth transaction process. - Seamless Integration: Plan and execute a detailed integration plan to optimize synergies and minimize disruption to operations.

Overcoming Challenges in Mergers and Acquisitions

M&A transactions can also present challenges that need to be carefully managed:

- Cultural Integration: Merging two distinct corporate cultures can be challenging. Address cultural differences early on and establish clear communication and decision-making processes. - Operational Inefficiencies: Mergers can lead to operational inefficiencies due to duplicate processes and systems. Plan for a smooth transition and streamline operations to maximize efficiency. - Resistance to Change: Employees may resist change brought on by M&A. Effective communication, transparent decision-making, and engagement with employees can help mitigate resistance. - Hidden Liabilities: Due diligence may not uncover all potential liabilities. Conduct thorough legal and financial assessments and establish appropriate risk mitigation strategies.

Navigating the intricacies of mergers and acquisitions requires a comprehensive understanding of the process, potential benefits, and challenges involved. By following the strategies outlined in this guide, business leaders can increase their chances of success in M&A transactions.

Remember that mergers and acquisitions are transformative events that can significantly impact a company's future. Approach these transactions with a clear strategic vision, meticulous planning, and a commitment to effective execution and integration. By embracing the principles outlined in this guide, organizations can harness the power of M&A to drive growth, diversification, and long-term success.

4.5 out of 5

| Language | : | English |

| File size | : | 843 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 422 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Stephen Manes

Stephen Manes Harusame

Harusame Mariane A Neves

Mariane A Neves Harry Turtledove

Harry Turtledove Judy John Baptiste

Judy John Baptiste Holly Alexander

Holly Alexander Henry Mintzberg

Henry Mintzberg Harvey Young

Harvey Young Hazel Henderson

Hazel Henderson Omid Safi

Omid Safi Harold James

Harold James Rav Berg

Rav Berg Marc Vetri

Marc Vetri Helen Palmer

Helen Palmer Heather Lean

Heather Lean Healthryt Brand

Healthryt Brand Helen Perelman

Helen Perelman Howard Means

Howard Means Rizwan Virk

Rizwan Virk Herbert L Kaufman

Herbert L Kaufman

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Ian MitchellFollow ·17.6k

Ian MitchellFollow ·17.6k Gilbert CoxFollow ·3.7k

Gilbert CoxFollow ·3.7k Dean ButlerFollow ·15.5k

Dean ButlerFollow ·15.5k Michael SimmonsFollow ·15.9k

Michael SimmonsFollow ·15.9k Aleksandr PushkinFollow ·4.1k

Aleksandr PushkinFollow ·4.1k Christopher WoodsFollow ·17.8k

Christopher WoodsFollow ·17.8k Jamie BellFollow ·19.5k

Jamie BellFollow ·19.5k Chase SimmonsFollow ·3k

Chase SimmonsFollow ·3k

Fabian Mitchell

Fabian MitchellUnleash the Adventure: Family Fun in the Black Hills

Nestled amidst the rolling hills...

Alfred Ross

Alfred RossUnleashing Peak Business Performance: A Journey of...

In today's rapidly evolving business...

Fernando Bell

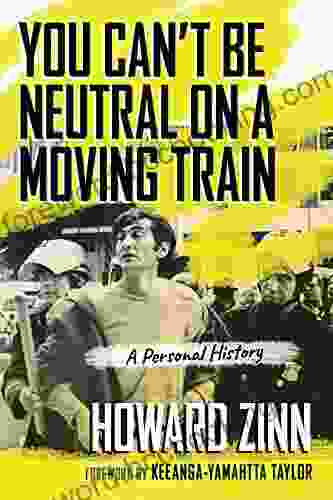

Fernando BellEmbrace the Prophetic Voice of Howard Zinn: A Journey...

As we navigate the complexities of our...

Jonathan Franzen

Jonathan FranzenChildren of the Arctic: A Literary Expedition to the...

In the annals of...

Branson Carter

Branson CarterYou Can Be Neutral on a Moving Train: A Transformative...

Welcome, dear reader,...

4.5 out of 5

| Language | : | English |

| File size | : | 843 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 422 pages |

| Lending | : | Enabled |